If you are new to Medicare or shopping for a supplemental plan, Medicare Supplement Plan F may have caught your attention. Medicare Supplement (Medigap) Plan F is the most comprehensive Medicare Supplement option available for qualifying Medicare seniors.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Specifically, this plan covers 100% of your Medicare cost-sharing and leaves you with no out-of-pocket expenses for Medicare-covered services. Below, we help you understand when Medicare Supplement Plan F is the best choice for you and whether you’re eligible.

Original Medicare (Part A and Part B) only covers 80% of the out-of-pocket costs for Medicare-approved services. Thus, Medicare Supplement (Medigap) policies can save you money on your healthcare in retirement.

Medicare Supplement Plan F is a standardized Medicare Supplement plan that covers all the gaps in coverage Original Medicare leaves behind.

Standardized coverage means that all benefits are the same regardless of the carrier through which you enroll. For example, a Medicare Supplement Plan F through Mutual of Omaha covers the same benefits as a Medicare Supplement Plan F through Aetna. Due to standardized benefits, you can use your Medigap coverage at any doctor or hospital that accepts Original Medicare.

Once you enroll in Medicare Supplement Plan F, you will have $0 cost-sharing, other than your monthly Medicare Part B and Medigap premiums. This type of plan is called first-dollar coverage. First-dollar coverage means you receive coverage from the first dollar you spend under your policy. Once Medicare pays its share of your medical-related costs, your Medigap Plan F will pick up the remaining balance, leaving you paying nothing.

Listen to this Podcast Episode Now!

All Medigap plans of the same letter share identical benefits, regardless of carrier. This is due to the federal standardization of Medicare Supplement plans. Thus, reviewing all available plan options is the best way to determine which Medigap plan letter is best for you.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

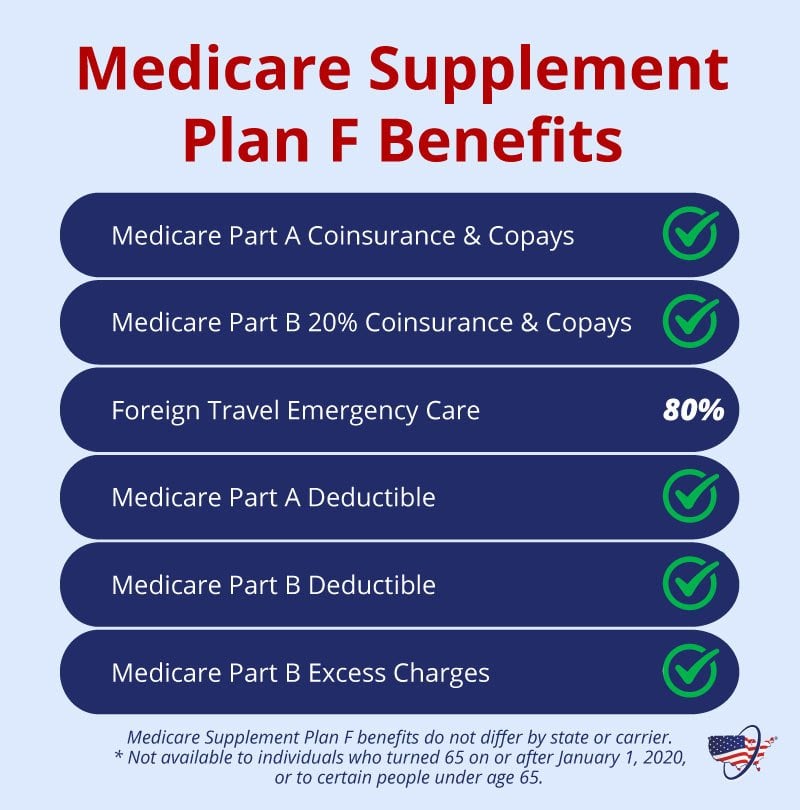

Medicare Supplement Plan F is not lacking when it comes to benefits. This plan offers the highest benefit level of all Medicare Supplements. A unique feature of Medicare Supplement Plan F is that it covers costs from the very first dollar spent. Meaning, you will pay no out-of-pocket costs for services covered by Medicare.

So, when you enroll in Medicare Supplement Plan F, you are not responsible for any Original Medicare copayments, coinsurances, or deductibles. As long as you stay current on your monthly premium, you won’t pay a penny more out-of-pocket.

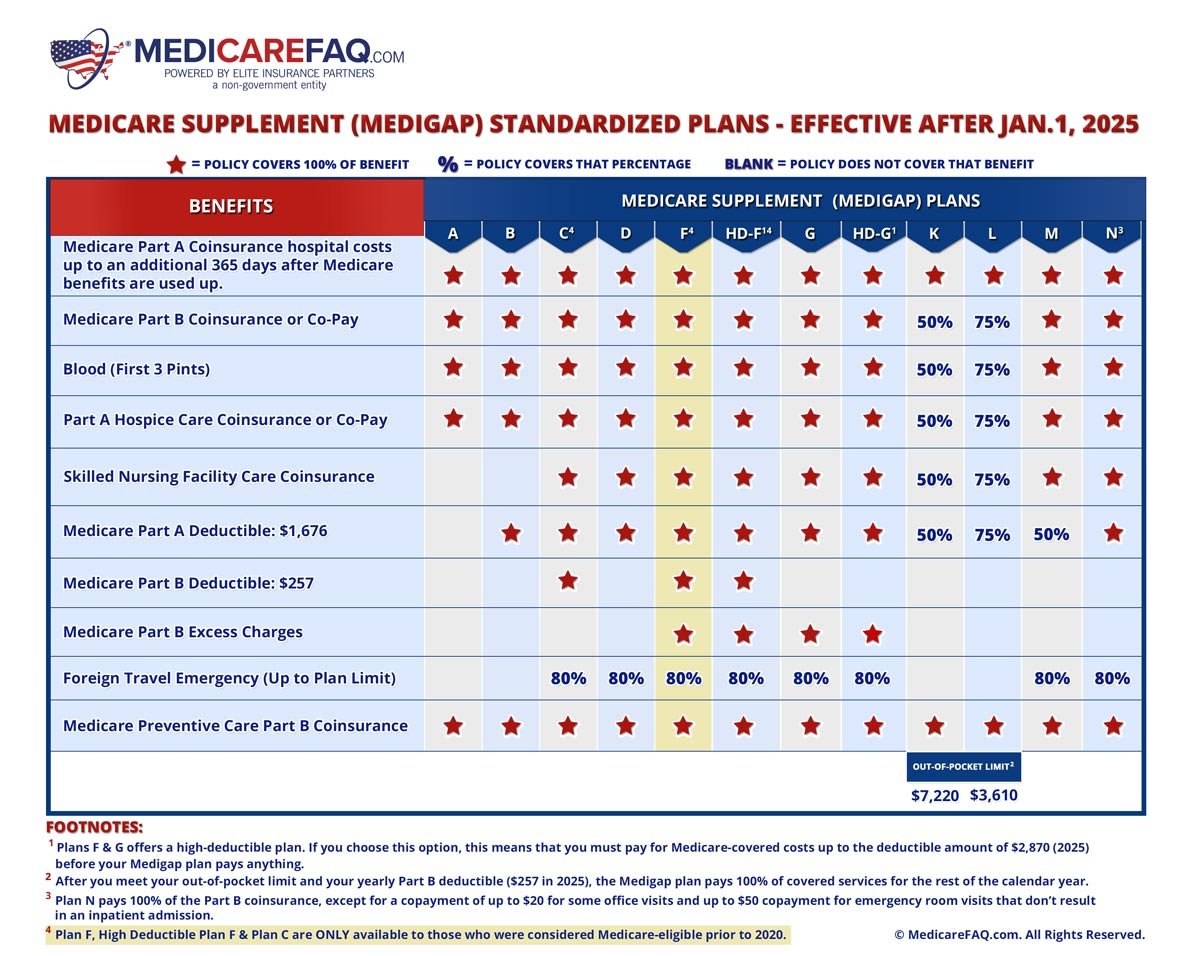

There are 12 Medicare Supplement plans available to seniors. Ten plans are identified by a letter, A through N, plus there are high-deductible versions of two plans.

Medicare Supplement Plan F covers all services Medicare Part A and Part B cover. If your doctor accepts Original Medicare and Medicare pays its benefit first, your Medicare Supplement Plan F will cover the rest of the costs.

This coverage picks up all the costs Original Medicare leaves for you to pay. In addition to these costs, Medicare Supplement Plan F also includes foreign travel emergency coverage. Medicare Supplement Plan F will cover a lifetime limit of $50,000 of emergency foreign travel coverage after a $250 deductible.

Although Medicare Supplement Plan F covers the most out-of-pocket costs among all Medicare Supplement plans, there are still benefits that the plan does not include.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

If you enroll in Medicare Supplement Plan F, these benefits are not unobtainable. However, you will also need to purchase a separate policy to receive additional coverage. It is not uncommon for Medicare Supplement policyholders to have stand-alone plans for other desired benefits.

Medicare Supplement Plan F premiums may be more expensive than other Medicare Supplement plans. However, the reason for the higher premium is that this plan provides the highest level of benefits to enrollees.

The plan’s average cost is about $230 per month. However, many factors impact the premium price. Premium costs for Medicare Supplement Plan F can range from around $150-$400 per month or more. Factors determining your cost include your ZIP Code, gender, age, tobacco use, and more.

Remember that the monthly premium for Medicare Supplement Plan F is the only out-of-pocket cost you will pay for your Medigap coverage. You will not be responsible for copays, coinsurance, or deductibles for your services. So, paying a higher premium may save you money in the long run.

Below, we’re comparing the average monthly costs of Medicare Supplement Plan F coverage across multiple cities. For our methodology, we’ve used data for both male and female residents that are ages 65 and 75. None use tobacco products:

| Plan F Average Monthly Cost in Las Vegas, NV (88901)* | |

| Gender: Female, Age: 65 | $298.00 |

| Gender: Male, Age: 65 | $336.00 |

| Gender: Female, Age: 75 | $317.00 |

| Gender Male, Age: 75 | $356.00 |

| *Please note: the above are sample rates. These are subject to change. Call us for your accurate, personalized quotes today. You must be eligible for Medicare before 01/01/2020 to enroll in Medicare SupplementPlan F. | |

| Plan F Average Monthly Cost in New York, NY (10001)* | |

| Gender: Female, Age: 65 | $548.00 |

| Gender: Male, Age: 65 | $548.00 |

| Gender: Female, Age: 75 | $548.00 |

| Gender Male, Age: 75 | $548.00 |

| *Please note: the above are sample rates. These are subject to change. Call us for your accurate, personalized quotes today. You must be eligible for Medicare before 01/01/2020 to enroll in Medicare SupplementPlan F. | |

| Plan F Average Monthly Cost in Chillicothe, OH (45601)* | |

| Gender: Female, Age: 65 | $263.00 |

| Gender: Male, Age: 65 | $298.00 |

| Gender: Female, Age: 75 | $295.00 |

| Gender Male, Age: 75 | $338.00 |

| *Please note: the above are sample rates. These are subject to change. Call us for your accurate, personalized quotes today. You must be eligible for Medicare before 01/01/2020 to enroll in Medicare Supplement Plan F. | |

| Medigap Plan F Pros | Medigap Plan F Cons |

|---|---|

| More benefits than any other Medigap plan available | Enrollment is only for those eligible for Medicare benefits before January 1, 2020 |

| Guaranteed issue rights during qualifying life events | The sizable number of benefits also means you’ll pay a higher premium on average |

| Notable savings for your health expenses through comprehensive coverage | Plan F premiums will rise over time as fewer people enroll |

Finding the right company can feel like an impossible task with so many options, but with the help of a licensed Medicare agent, you can compare your options and find the right coverage for your healthcare and budget.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

Due to standardization, all Medicare Supplement Plan F policies have the exact same benefits regardless of the carrier you enroll with. No carrier can change the benefits by this plan covers. However, in some circumstances, you may be eligible for perks that come with being enrolled through certain carriers, such as gym memberships or discounts on eyeglasses or hearing aids. Yet, these additional perks must be given to all policyholders from the same carrier regardless of the plan they enroll in.

Unfortunately, not every Medicare beneficiary can enroll in Medicare Supplement Plan F, as the plan was discontinued for many Medicare seniors. You are only eligible to enroll if you received any part of Medicare before January 1, 2020. This is due to a change in Medicare known as MACRA.

MACRA is the Medicare Access and CHIP Reauthorization Act. This change to Medicare eliminated all first-dollar coverage plans for new Medicare beneficiaries.

Those who enrolled in Original Medicare before the deadline are still eligible to freely enroll and disenroll in Medicare Supplement Plan F just as they could before MACRA. However, new Medicare seniors are unable to enroll in the plan.

In 47 of 50 states, beneficiaries can enroll in Medicare Supplement Plan F. The three states that do not offer this plan are Massachusetts, Minnesota, and Wisconsin. These three states have Medicare Supplement plans similar to the lettered plans available in most other states, but with different naming conventions.

When you move to a new state, you can keep your current Medicare Supplement plans. In most cases, you must contact your carrier and submit your new address. Since Medicare Supplement plans are standardized, your benefits will not change. However, your premium may increase or decrease depending on your new ZIP Code.

Suppose you are interested in enrolling in Medicare Supplement Plan F but find that the premium rates are more than you want to spend. In that case, Medicare Supplement High Deductible Plan F is a potential alternative for you to consider. The lower premium could be worth it if you are comfortable needing to reach a higher deductible before receiving full coverage.

Medicare Supplement High Deductible Plan F provides the same excellent Plan F benefits at a lower premium price by eliminating first-dollar coverage. Once you meet the deductible, you receive 100% coverage from the high-deductible version.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

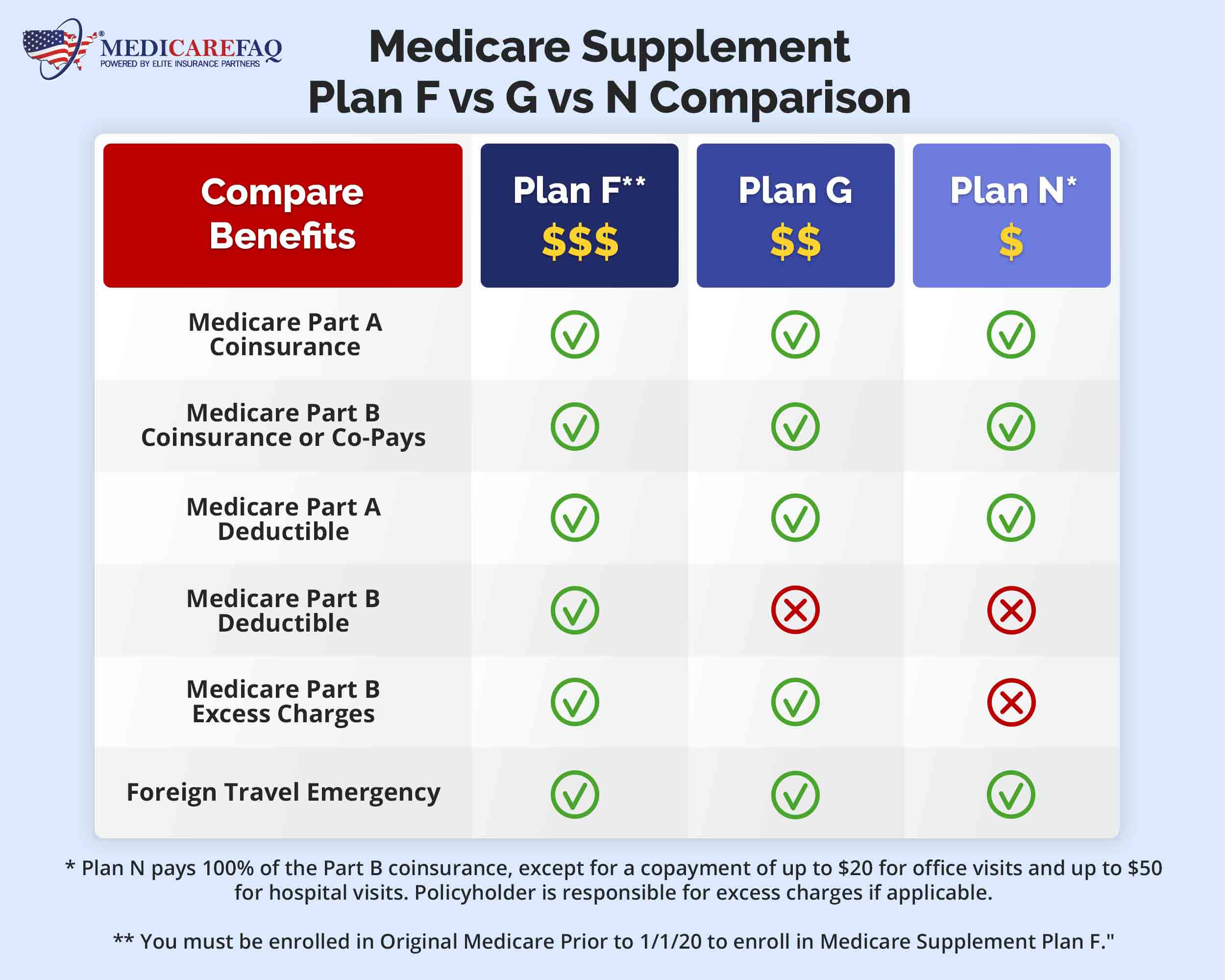

For those who missed eligibility for Medicare Supplement Plan F, Plan G could be a great alternative if you wish to have comprehensive coverage with a low deductible and a lower monthly premium. Plan G may be worth considering. The chart below compares the top three plans in 2024.

Each year, Medigap plan premiums are subject to rate increases. This is especially true for Medicare Supplement Plan F due to its phasing out. As fewer people enroll each year, the insurance carrier’s risk grows, increasing premiums at a higher rate than other Medigap plans.

It is beneficial to research rate increase histories and pricing methods when choosing a plan. Over the past five years, Medicare Supplement Plan F rate increases have been between 3% and 6%. However, that number is quickly rising.

Ask your agent what the rate increase history is for the Medicare companies with which you are considering enrollment. You will want to research carrier reviews before making a choice.

Medicare Supplement Plan F will only cover the costs of prescription drugs administered at the hospital that typically receive coverage from Medicare Part A. However, Medicare Supplement Plan F will NOT cover prescription drugs you take at home. You will want to enroll in a Medicare Part D plan to receive prescription drug coverage. Medicare Part D prescription drug plans work alongside Original Medicare – with or without a Medicare Supplement plan.

You can enroll in Medicare Supplement Plan F at any time, as long as you are eligible. However, the best time to sign up for any Medigap plan is during your one-time Medicare Supplement Open Enrollment Period.

If you apply outside this window or do not have guaranteed issue rights, you must answer underwriting eligibility questions and await application approval.

Find Medicare Plans in 3 Easy Steps

Let us help you navigate your Medicare journey

There is no such thing as Medicare Part F. Medicare Parts refer to Parts A through D, which are the parts of Original Medicare, Medicare Advantage, and Medicare Part D prescription drug coverage. The Plan letters refer to Medicare Supplement plans, which include Medicare SupplementPlan F.

Is Medicare Supplement Plan F still available?Medicare Supplement Plan F is still available to seniors who were Medicare-eligible before the plan’s elimination.

Is Plan F the best Medicare Supplement?The best Medicare Supplement plan for you is the plan that provides you with the best value. For some, Medicare Supplement Plan F does this by covering all cost-sharing. However, Medicare Supplement Plan F may not be the best plan for others due to budgetary reasons.

Is Medicare Supplement Plan F better than Plan G?Medicare Supplement Plan F offers the most coverage of all Medigap plans. Yet, it is not available to all beneficiaries, and the Medicare Part B deductible you save with Plan F might be less than the premium savings you get with Plan G.

Is Medicare Advantage better than Medicare Supplement Plan F?The answer to this question differs for each person. Your healthcare coverage goals will determine which is better for you. For example, if you do not want to deal with restrictive doctor networks, Medicare Supplement Plan F is the better choice. But if keeping monthly premiums low is more important to you, a Medicare Advantage plan would be more suited to your needs.