Form FTB3567 Installment Agreement Request - California

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3567?

A: Form FTB3567 is a form used in California to request an installment agreement for paying taxes.

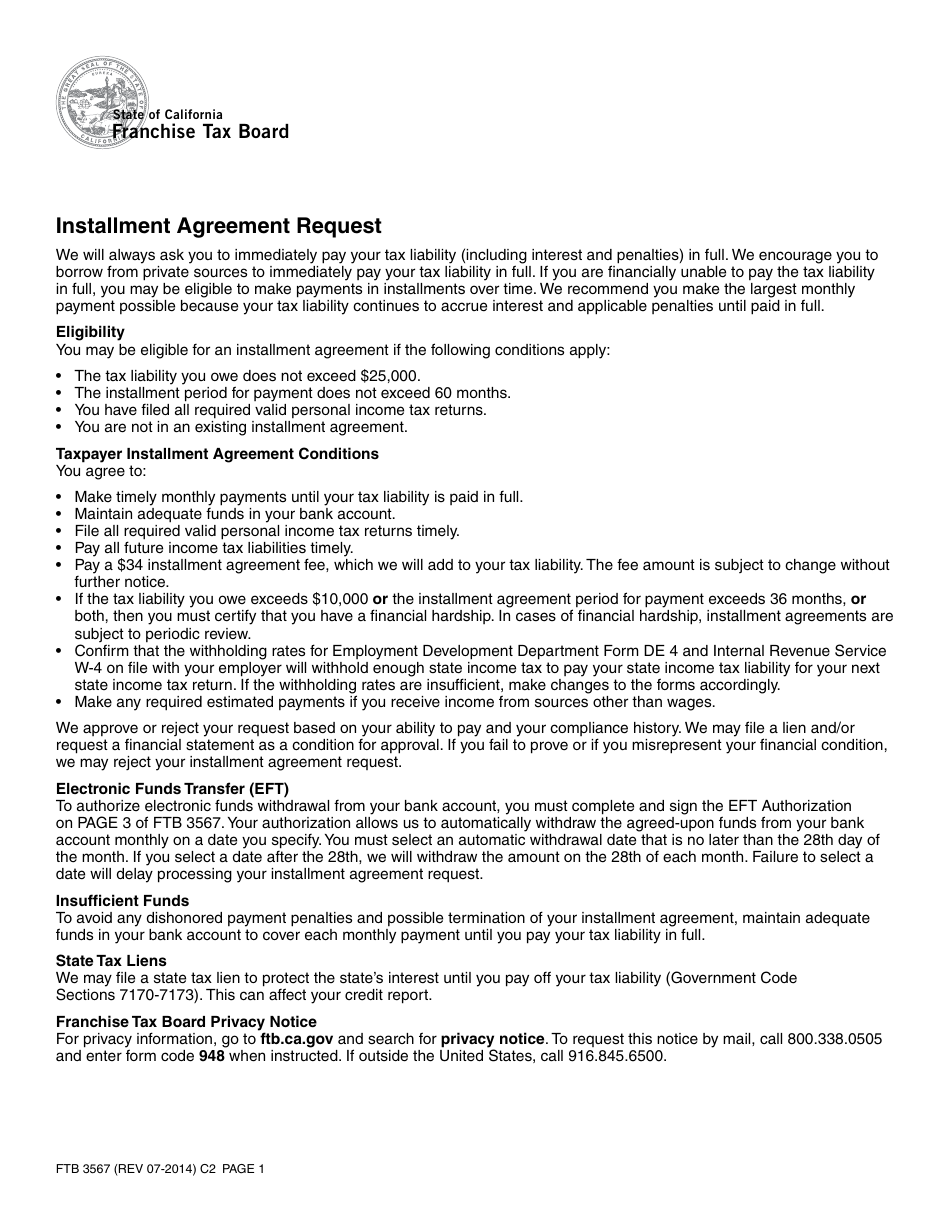

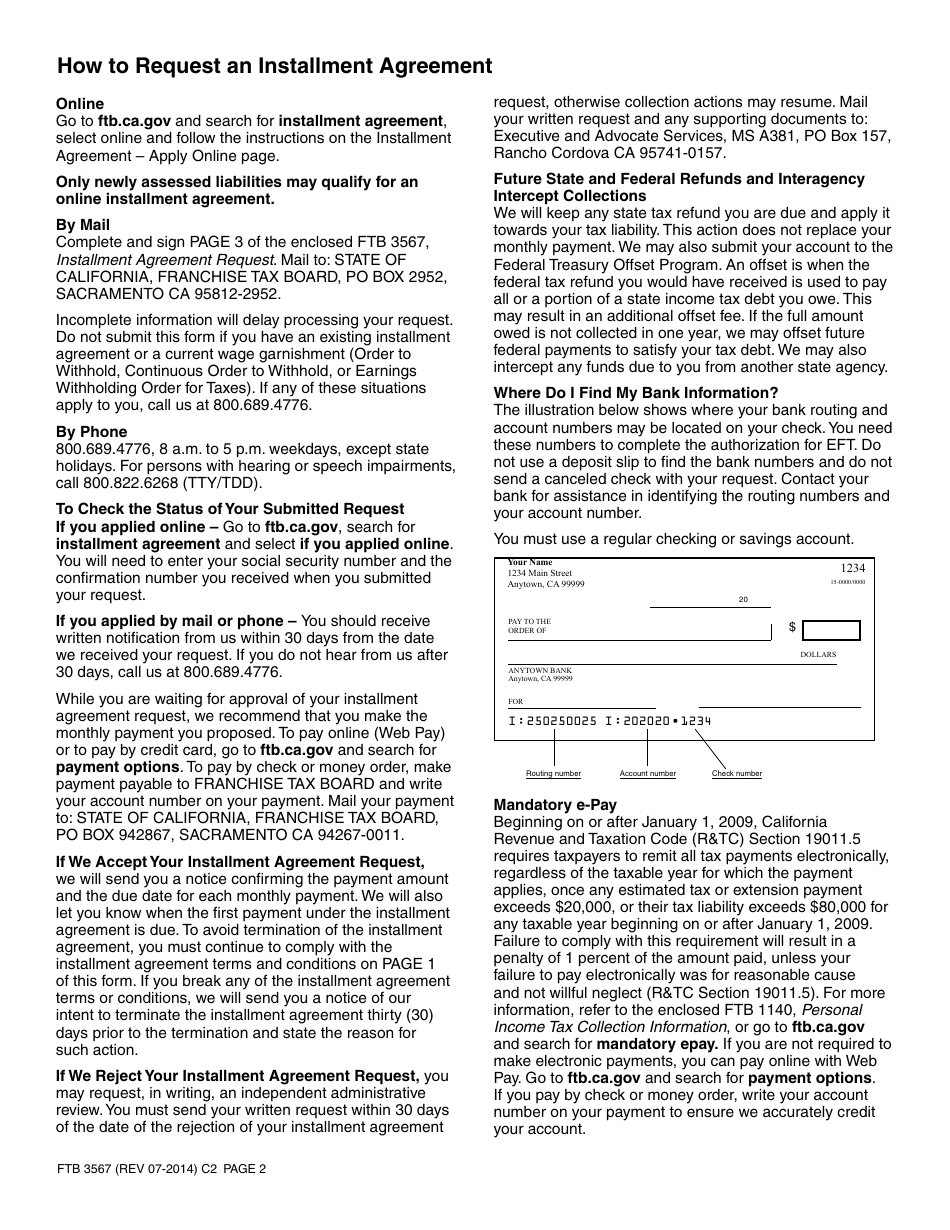

Q: What is an installment agreement?

A: An installment agreement is a payment plan that allows taxpayers to pay their taxes in monthly installments.

Q: Who can use Form FTB3567?

A: Any individual or business that owes taxes to the California Franchise Tax Board can use Form FTB3567 to request an installment agreement.

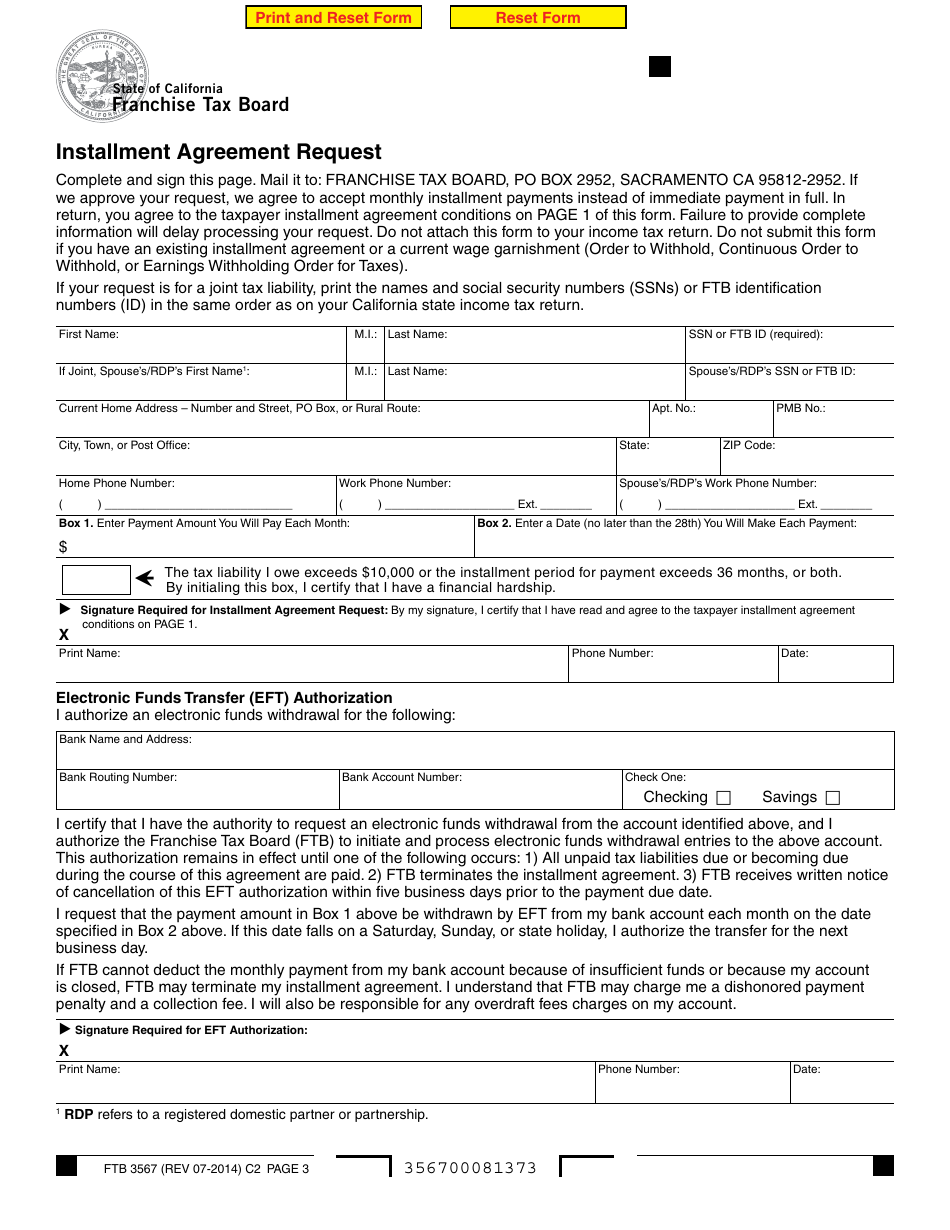

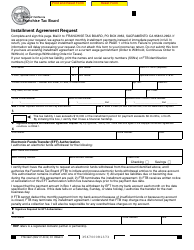

Q: How do I fill out Form FTB3567?

A: You will need to provide your personal information, tax liability details, and propose a monthly payment amount on the form.

Q: Are there any fees for requesting an installment agreement?

A: Yes, there is a $34 fee for setting up an installment agreement with the California Franchise Tax Board.

ADVERTISEMENT

Form Details:

- Released on July 1, 2014;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3567 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.

Download Form FTB3567 Installment Agreement Request - California

4.7 of 5 ( 49 votes )

1

2

3

Prev 1 2 3 Next

ADVERTISEMENT

Linked Topics

Tax Installment Installment Agreement Tax Agreement California Franchise Tax Board Tax Payment Form California Legal Forms United States Legal Forms

Related Documents

- Form TR-300 Agreement to Pay and Forfeit Bail in Installments - California

- Form TR-300 Agreement to Pay and Forfeit Bail in Installments - County of San Mateo, California

- Form TR-310 Agreement to Pay Traffic Violator School Fees in Installments - California

- IRS Form 9465 Installment Agreement Request

- IRS Form 433-H Installment Agreement Request and Collection Information Statement

- IRS Form 433-D Installment Agreement

- Application and Agreement to Enter Into an Installment Payment Plan - Riverside County, California

- IRS Form 9465 (ZH-T) Installment Agreement Request (Chinese)

- IRS Form 9465 (ZH-S) Installment Agreement Request (Chinese Simplified)

- Form TR-300 (ONLINE) Online Agreement to Pay and Forfeit Bail in Installments - Draft - California

- Form TR-310 (ONLINE) Online Agreement to Pay Traffic Violator School Fees in Installments - California

- TTB Form 5600.31 Application for Installment Agreement

- Form PHS-6189-1 Retention Bonus (Rb) Agreement Request

- DD Form 2903-2 Voluntary Separation Incentive Pay Agreement BI-Weekly Installment Payment

- IRS Form 13844 Application for Reduced User Fee for Installment Agreements

- Form PHS-7015-1 Board Certification Incentive Pay (Bcip) Agreement Request

- Form CEM-2407 Disadvantaged Business Enterprises (Dbe) Joint Check Agreement Request - California

- Form DOT LAPM9-K Dla Disadvantaged Business Enterprises (Dbe) Joint Check Agreement Request - California

- Form DOT LAPM9-A Dla Disadvantaged Business Enterprises (Dbe) Joint Check Agreement Request - California

- Form PHS-7033 Accession Bonus (AB) or Critical Wartime Skills Accession Bonus (Cws-AB) Agreement Request

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.