Many landlords choose to collect a security deposit when a new tenant signs a rental agreement. Requiring a deposit offers some protection for the landlord, and it can also be a financial incentive for the renter, encouraging them to maintain the property and uphold the terms of the lease.

If you are collecting a security deposit from your renter, it’s a good idea to require payment when the lease is signed or prior to move-in. Then, document the payment by providing your tenant with a security deposit receipt. While it’s common to require the full security deposit payment upfront, tenants may have a right to request installment payments, so be sure to check your local laws.

Note: This guide is for informational purposes only. Zillow, Inc. does not make any guarantees about the sufficiency of the information in or linked to from this guide, or that it’s compliant with current, applicable or local laws. Landlord-tenant laws change rapidly and may be regulated at the federal, state and local levels. This resource is not a substitute for the advice or service of an attorney; you should not rely on this resource for any purpose without consulting with a licensed attorney in your jurisdiction.

A security deposit receipt functions as the tenant’s proof of payment, and it also indicates where the deposit is being held for the duration of the lease.

A copy of the security deposit receipt should be shared with the tenant within 30 days of receiving the deposit.

Tip: You can use Zillow Rental Manager to easily collect payments from tenants online, including security deposits, monthly rent and utilities.

Security deposit amounts vary greatly by market, but a national survey of renters* found that the typical amount in 2019 was $600. Keep in mind that some cities and states limit the maximum amount you can charge, so be sure to familiarize yourself with the laws in your area.

According to the same survey, a security deposit is one of the most common upfront rental costs, but 35% of renters say it’s a challenge to save for costs like application fees and security deposits. To keep your rental competitive and affordable, be mindful of your total upfront deposits and fees, even if your jurisdiction does not have a security deposit limit.

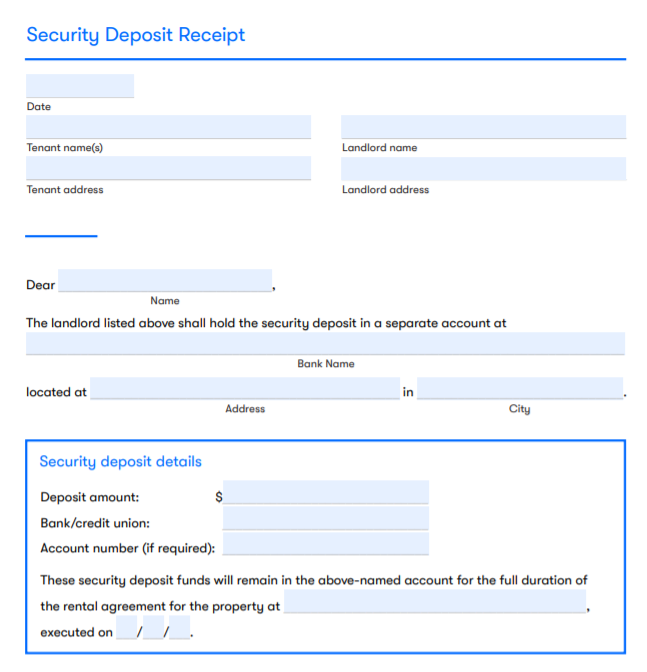

When writing a security deposit receipt, include the following information:

You can download the security deposit receipt template seen below by clicking on the image or on the green Download button at the top of this page. Simply add the relevant information, print the PDF, and attach a copy of the deposit receipt form to the lease and send it to your tenant, or scan and email a copy.

When a tenant moves out, you’ll send your tenant a security deposit return letter that itemizes the cost of any damages or repairs the tenant is responsible for (if applicable), the remaining balance of the security deposit after those costs are deducted, and the amount being refunded. Make sure you have a valid forwarding address for your tenant so you know where to send their refund, and be aware of any local laws that specify the time frame for returning the deposit after the lease has ended.

The security deposit return letter does not typically include bank information, but it may include the amount of interest accrued on the deposited funds while they were being held. Some states require you to return the security deposit plus interest that accrues during the lease, while others don’t specify or have different requirements, so check your state and local laws to understand your obligations.

For additional landlord tools, forms and receipts, visit our Resource Center .

* Zillow Group Consumer Housing Trends Report 2019