A check request form allows an individual, vendor, or company to ask for reimbursement or pre-payment from a business, organization, or other entity distributing money. Employees use a check request to pay or receive compensation for a company-related purchase, such as equipment, supplies, or travel arrangements. Individuals in other organizations, such as non-profits, churches, or volunteer groups, may use a check request form to purchase goods and services on behalf of their organization. Ultimately, the check request form acts as a payment record and ensures the correct individuals have authorized the payout.

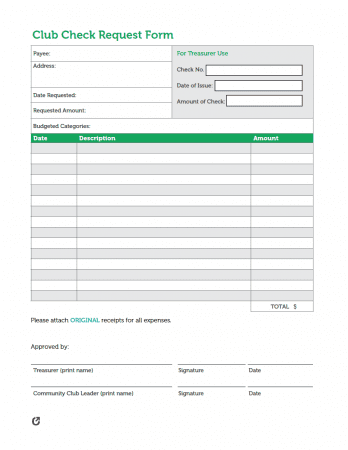

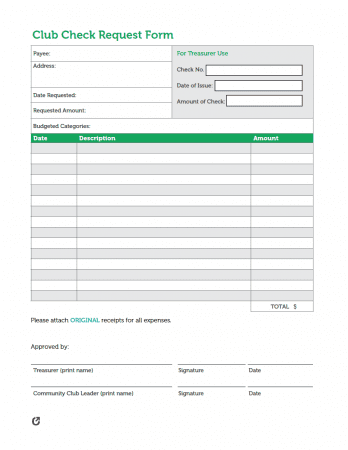

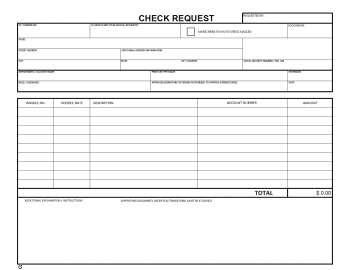

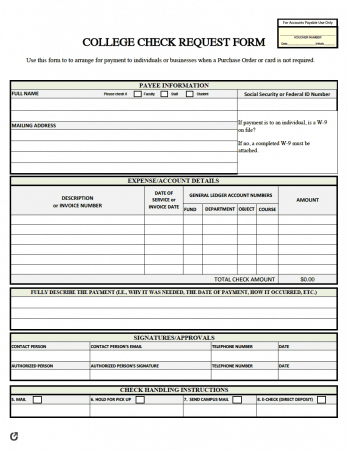

A check request form is a template that employees, vendors, companies, or individuals use to request payment or reimbursement formally. Some organizations may require the use of an internal, uniform check request form. However, contractors, employees, volunteers, and vendors can also download a template to create a personal check request.

The individual completing the check request form must ensure that they have accurately filled in their information. Skipping fields, entering incorrect information, or writing in a hard-to-read color or font can cause delays in the reimbursement process. Re-reading the document and having another person look it over minimizes the risk of errors, which, therefore, allows you to receive your check sooner.

Understanding how to use a check request form prevents delays or miscommunication between parties. After choosing the desired format, gather the necessary information or documents to ensure efficiency. Often, the business or individual requires that you submit receipts or related documentation with the check request form as proof of purchase. Therefore, having the paperwork with you while filling out the request form makes it easier to complete.

Consider the purpose of the form as it may have different requirements. For instance, a volunteer organization’s check request form may look different from one for a corporate organization. Choosing the layout with the most relevant fields is essential to receive compensation diligently.

The information to include may differ for each form, but generally, the form will require:

Other necessary items, such as receipts, invoices, or price quotes, typically need to be attached to the check request form, as well.

Download the form and save it to a folder on your computer. You can fill it out electronically or print it and write it out by hand. If you request checks frequently, having quick access to a blank template will save time in the future.

Submit the check request to the appropriate person or department. Depending on the organization, this may be a supervisor, treasurer, or accounting department. Make sure to submit it in their preferred method – by hand, mail, or electronically.

A check request form provides several benefits for the parties involved. Most importantly, it prevents individuals from paying for costs out of pocket. It works by informing the company or organization of the expense and the reason(s) for purchasing the item or service.

The person requesting a check may not want to use their own money. In this case, they must complete the form in advance and receive permission from the treasurer, department head, or another authorized person. Once they receive the check, they would only have the ability to use it towards the approved purchase. In other words, they could not use it to pay for another item or a personal expense.

On the other hand, a person can submit a check request after the purchase to receive reimbursement. However, this situation could become tricky if the company or organization denies the request. They could disapprove because they cannot afford it or do not consider it a beneficial purchase. As a result, the individual would not receive compensation. To prevent this situation, the individual should consult the company or organization before purchasing. By doing so, the person knows that they will receive payment.

Additionally, the check request form acts as a record of the transaction. The person storing the document must file it in a safe place. If any questions arise after the sale, the business or group can reference the form to see the payment details. Similarly, if someone claims they did not receive a check, the organization can fact-check it using their records.

A check request form also keeps the books and budget up to date from the organization’s perspective. Having this information allows the treasurer to adjust the budget as needed. For example, the company or organization might decide to make the expense regular (i.e., weekly, monthly, or yearly). As a result, they would need to budget to ensure they have enough money in the account for it. If they cannot afford it, they would have to boost fundraising efforts, obtain a loan, or decrease other less-important expenditures.

Most companies or organizations require the authorization of a check request form. The person who oversees the money must approve the document in writing before the individual receives a check. Since it requires an official signature from a specific party, the form prevents fraud.